Sales territory planning is the art and science of carving up your total market into manageable chunks and handing them to your sales reps or teams. But let's be clear: this isn't about just drawing lines on a map of Ireland. It's about strategically matching your best people with your most valuable opportunities to build a predictable, scalable revenue engine.

Why Smart Sales Territory Planning Drives Growth

Too many sales leaders get this wrong. They see territory management as a dull administrative task—something to tick off a list. So, they split Ireland by county or hand out accounts based on a gut feeling. Honestly, this is a fast track to disaster. It creates missed revenue pockets, burned-out reps, and a reactive sales culture that’s always playing catch-up.

When territories are lopsided, you’re basically creating a system of "haves" and "have-nots." One rep gets swamped with low-potential accounts scattered across three provinces, while another has a compact, high-value patch right on their doorstep. This kind of imbalance doesn't just crush morale; it torpedoes your bottom line and makes consistent performance a pipe dream.

Transforming from Reactive to Proactive

Strategic territory planning is what separates the pros from the amateurs. It shifts your sales function from a group that just reacts to inbound leads into a disciplined, data-driven growth machine. By designing territories with real thought, you create a clear roadmap for success and hold everyone accountable. No more high-potential prospects falling through the cracks.

This strategic mindset brings some serious advantages:

- Boosted Sales Productivity: Reps spend less time stuck in traffic on the M50 and more time on what matters: prospecting and closing deals.

- Improved Customer Relationships: With a manageable workload, your reps can give each account the focused attention it deserves, building much stronger, lasting partnerships.

- Enhanced Team Morale: When territories are fair and balanced, every rep feels they have an equitable shot at hitting their quota. This fosters a healthier, more competitive spirit.

- Clearer Performance Measurement: Designing territories around potential makes it far easier to accurately assess rep performance. This clarity is absolutely essential for effective coaching and tracking sales performance.

The core idea is simple but powerful: Effective planning is not about geography. It is about strategically aligning your best sales resources with your most valuable market opportunities to create a predictable revenue stream.

The Financial Impact of Strategic Planning

Moving to a more structured model isn't just theory—it delivers real, tangible results. The numbers don't lie. Recent analysis shows that organisations that adopt a data-driven approach to sales territory planning see, on average, a 15% increase in revenue and a 20% uplift in sales productivity.

Even better, these companies slash their planning time by about 75%. Think about what your leadership team could do with all that extra time—more coaching, more strategy, more execution. You can dig into more of the data-backed findings on the impact of territory planning from Abacum.ai.

Ultimately, smart sales territory planning is a foundational pillar for any successful B2B sales strategy, especially in a competitive market like Ireland. It ensures your team is working smarter, not just harder, and puts your business in the best possible position to win market share and drive sustainable growth.

Building Your Foundation for Territory Design

Before you can even think about drawing lines on a map, you have to get the groundwork right. Smart sales territory planning isn’t about guesswork or simply carving up the country by county. It's built on a solid foundation of clean, reliable data.

Getting this initial analysis right is everything. If you start with faulty data, every decision you make from that point on will be built on a shaky base.

Your first move should be an honest look at your current sales performance. Dive into your CRM and pull the reports that show you who your best reps are, which accounts are driving the most revenue, and what regions are knocking it out of the park. You're looking for the DNA of your success. What industries have the highest lifetime value? Which deals close the fastest? This isn’t just about a pat on the back; it’s about figuring out what works so you can do more of it.

Gathering and Cleaning Your Core Data

The quality of your territory plan is directly linked to the quality of your data. It's a cliché for a reason: garbage in, garbage out. You need to pull information from your CRM, marketing automation platforms, and any market intelligence tools you're using. But just having the data isn't enough—it has to be accurate.

Data cleaning feels like a chore, I get it. But it's absolutely non-negotiable. This means you need to:

- Merge Duplicates: Get rid of multiple entries for the same company or contact.

- Standardise Fields: Make sure industries, locations, and company sizes are all recorded the same way. Is it "Ltd" or "Limited"? "Dublin 2" or "D2"? Consistency matters.

- Update Old Info: Remove contacts who’ve left their roles and fix outdated addresses.

Think of it as prepping a construction site. You wouldn't pour concrete on uneven, messy ground. In the same way, you can’t build balanced, effective sales territories on a foundation of messy data. This grunt work ensures the models you build later actually reflect what's happening in the real world.

To build a robust foundation for sales territory planning, you need to collect and organize specific metrics from various systems. The table below outlines the essential data categories that will give you a clear, 360-degree view of your market and performance.

Essential Data for Modern Territory Analysis

| Data Category | Key Metrics to Collect | Primary Source System |

|---|---|---|

| Customer Data | Account location, industry/vertical, annual revenue, employee count, purchase history, lifetime value (LTV). | CRM (e.g., Salesforce) |

| Sales Performance | Win/loss rates per rep, sales cycle length, deal size, leads per territory, quota attainment. | CRM, Sales Analytics |

| Market Potential | Total Addressable Market (TAM) size, competitor presence, industry growth rates, regional economic data. | Market Intelligence Tools |

| Lead & Prospect Data | Lead source, engagement scores, firmographics of new leads, ICP alignment. | Marketing Automation |

Having this data cleaned and ready is the difference between a territory plan that looks good on paper and one that actually drives revenue.

Defining Your Market and Ideal Customer

With clean data in hand, you can start to get specific about who you’re targeting. This comes down to two crucial concepts: your Total Addressable Market (TAM) and your Ideal Customer Profile (ICP).

Your TAM represents the total possible revenue you could earn if you captured 100% of the market. For a B2B SaaS company in Ireland, this might be the total annual spend of every Irish business that could realistically use your software. It’s your universe.

Your ICP, on the other hand, is a laser-focused definition of the perfect company to sell to. This isn't just a vague persona; it's a detailed blueprint based on firmographic data like industry, employee count, annual revenue, and even the tech stack they use. This is where your earlier analysis of top-performing accounts becomes invaluable. Who are your best customers? Your ICP is a detailed, data-backed description of them.

At its core, sales territory planning is about segmenting your Total Addressable Market into manageable sections to maximize the efficiency of your sales force. The ultimate goal is to direct your team's energy towards nurturing the highest value relationships, which is a key strategy for winning in competitive markets.

By defining your TAM and ICP, you give your sales team a clear target. It stops them from wasting cycles on leads that are a poor fit and ensures your resources are aimed squarely at the most promising parts of the market. This focus is especially critical when you're in the process of building a startup sales team and every penny counts.

Finally, you need to set clear business goals to anchor your entire territory plan. Are you aiming to grow market share in Munster by 15%? Do you want to break into the booming fintech scene in Dublin? These objectives give your plan a purpose and a yardstick for measuring success down the line. Without clear goals, you're just moving lines around on a map.

Alright, you've cleaned up your data and have a crystal-clear picture of your goals. Now comes the most pivotal decision in your entire territory plan: picking the right segmentation model. This is where strategy gets real, moving beyond just drawing lines on a map to thoughtfully carving up your market.

The model you land on will literally dictate how your sales team spends its time and money. Get it right, and you align your reps' efforts with your most valuable opportunities. Get it wrong, and you're looking at wasted effort, missed quotas, and a team of frustrated reps. This isn't about what's easiest to set up; it's about what’s most effective for your specific business.

The Geographic Model: Old Faithful

The most traditional method is, of course, geographic segmentation. You're simply slicing up the map by physical boundaries—counties, provinces, or even specific postcodes in a city like Dublin. It's straightforward to implement and even easier for everyone to understand.

This model is a fantastic fit for businesses where physical presence is a massive factor. Think of a company selling industrial machinery or on-premise security systems. For them, cutting down travel time between client sites directly translates to more appointments and higher productivity. A rep covering Munster can cluster their meetings efficiently, spending less time on the M8 and more time selling.

But that simplicity is also its greatest weakness. A purely geographic model completely ignores account potential. A territory covering a huge, sparsely populated rural area might have a tiny fraction of the revenue potential of a small, dense territory in a city centre. This creates huge imbalances in opportunity, leading to unfair quotas and skewed performance metrics. For most modern B2B businesses, especially in the SaaS world, geography is often a secondary thought.

The Account-Based Model: Focusing on Potential

A much more sophisticated way to play the game is by segmenting based on account characteristics. This approach groups customers by their potential value or size, which creates a far more equitable distribution of opportunity across the team.

You can slice this a few different ways:

- By Account Size/Revenue: You might create territories for enterprise clients (say, companies with over €50 million in revenue), a mid-market tier, and a small business (SMB) segment. This lets reps specialise in the unique sales cycles and decision-making structures of each segment.

- By Account Potential: Using your Ideal Customer Profile (ICP) and historical data, you can score and grade every account. Your "Tier A" accounts—the ones with the highest potential—are grouped into one territory, "Tier B" into another, and so on. This ensures your top reps are laser-focused on your biggest fish.

This model is perfect for companies with a diverse customer base where deal size and complexity vary wildly. It ensures your most experienced "elephant hunters" aren't wasting their time on small, transactional deals, and your SMB-focused reps aren't overwhelmed by complex enterprise sales.

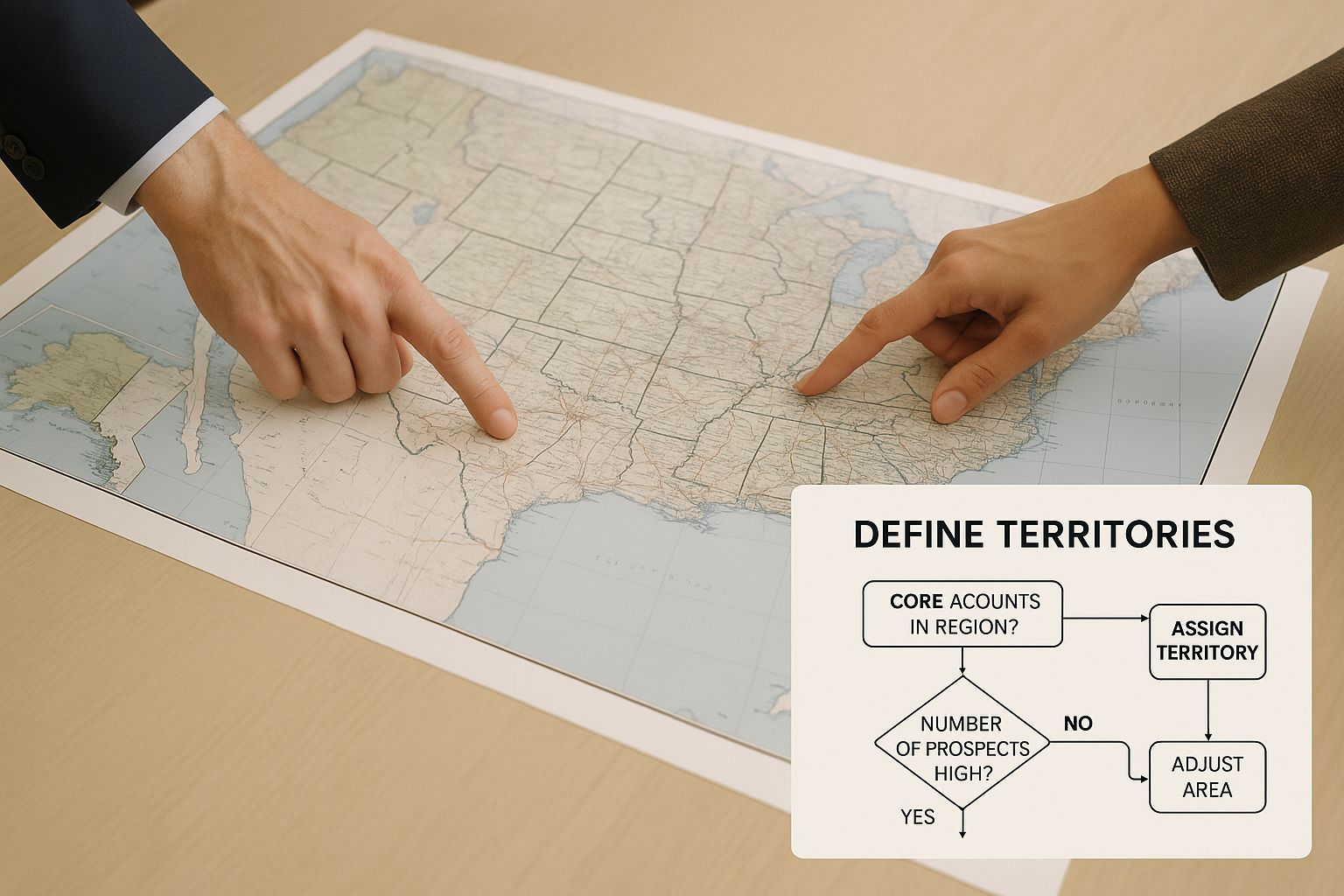

The image below really captures the spirit of this. It’s about teams getting together, armed with data and maps, to align their strategy with where the real market opportunities lie.

This is what effective territory planning looks like in practice—a collaborative, data-driven effort to point your resources in the right direction.

The Industry Vertical Model: Becoming the Expert

Another incredibly powerful approach is segmenting by industry, or vertical. With this model, one rep might own all the financial services clients across Ireland, while another focuses entirely on the booming life sciences sector in Cork and Galway.

The magic here is that it turns your sales reps into genuine subject matter experts. They learn the specific jargon, the deep-seated challenges, and the unique buying triggers of their assigned vertical. That kind of expertise builds massive credibility with prospects and can dramatically shorten sales cycles.

A rep who can talk knowledgeably about regulatory compliance with a fintech founder is infinitely more effective than a generalist who just knows the product features.

This strategy is ideal for B2B companies selling complex solutions where deep industry knowledge is a key differentiator. The only real downside is that it can create some geographic headaches if your target industries are spread thin across the country.

The Product Line Model: Specialised Knowledge

If your company offers multiple, distinct product lines that require different skill sets to sell, segmenting by product can be a game-changer. For example, a large IT provider might have one sales team dedicated to its cloud services and a completely separate team for its hardware solutions.

This structure ensures every rep has deep product knowledge and can field technical questions with confidence. It’s best suited for businesses with a diverse portfolio, especially where cross-selling is either uncommon or requires a formal hand-off to a specialist. The risk? A single customer might have to deal with multiple reps from your company, which can sometimes be a bit confusing for them.

Creating a Hybrid Model for Maximum Impact

Here's the reality: the best sales territory plans rarely stick to just one model. The most successful B2B companies I've seen in Ireland create hybrid models, blending elements from different approaches to build something that fits their unique market position.

For instance, an Irish SaaS company might build a hybrid plan that looks something like this:

- Primary Segmentation: Industry Vertical (Fintech, Agri-tech, Med-tech).

- Secondary Segmentation: Account Size (Enterprise vs. SMB within each of those verticals).

- Tertiary Layer: Geography (Reps for each segment are assigned to either Dublin/Leinster or the rest of Ireland to manage travel and build local relationships).

This layered approach gives you the best of all worlds. It allows reps to become industry experts (vertical), tailor their sales process to the buying committee (account size), and manage their time on the road effectively (geography).

Choosing your model is the cornerstone of your entire sales strategy. Take the time to really analyse your products, your customers, and your sales process. Pick the approach—or blend of approaches—that will put your team in the absolute best position to win.

Using Data to Create Balanced Territories

Once you’ve settled on a segmentation model, the real work begins. This is where you start populating those territories with actual opportunities. The goal isn’t just to draw lines on a map; it’s to create balanced territories that give every single sales rep a fair shot at hitting their quota.

Let’s be honest: unbalanced territories are one of the fastest ways to kill team morale. They create a toxic "haves vs. have-nots" culture that no manager wants to deal with.

Getting this balance right is a delicate mix of art and science, but it leans heavily on data. It’s about looking past simple account numbers and digging into the true potential of each patch. A territory with 20 high-value enterprise accounts in Dublin’s IFSC is a world away from one with 200 small businesses scattered across rural Connacht. Your data has to tell you that story.

Analysing Customer Potential and Market Saturation

First things first, you need to score your accounts. Don't just count them. You need a consistent, data-backed way to evaluate the potential hiding in each segment you’ve defined.

Start by getting your hands dirty in your CRM and sales data. You're hunting for patterns that signal a high-value opportunity. Look for key factors like these:

- Historical Spend: How much have similar accounts spent with you in the past? This is almost always your most reliable predictor of future value.

- ICP Fit: How closely does an account match your Ideal Customer Profile? Score them based on industry, company size, and other firmographics.

- Engagement Signals: Have they downloaded content, attended a webinar, or visited your pricing page? These digital breadcrumbs are strong indicators of intent.

Next, you have to assess market saturation and how crowded the competitive landscape is. If a territory is already packed with competitors, your reps will face a much tougher battle. This has to be factored into their workload and targets. On the flip side, a less saturated market might offer easier wins, even if the accounts look smaller on paper. This kind of detailed analysis is a core part of using data to drive a winning sales strategy in Ireland.

Building 'Smart' and Flexible Territories

With a clear picture of account potential, you can move on to building what we call 'smart' territories. This isn't about drawing static lines on a map anymore. It's about creating dynamic assignments that can shift and adapt as the market evolves. The best territory plans use advanced analytics to weigh customer potential, buying history, and competitive presence all at once.

This data-first approach ensures territories are balanced by real opportunity, not just account quantity. It frees up your reps to focus on high-quality leads instead of getting bogged down by a high volume of low-potential accounts. It also helps you optimise sales routes and cut down on non-selling time, which is a massive productivity boost for any field team.

A balanced territory doesn't mean every rep has the same number of accounts. It means every rep has an equal opportunity to achieve 100% of their quota based on the potential value within their assigned patch.

This concept is absolutely crucial. One rep might have 25 high-potential enterprise accounts, while another manages 150 SMB accounts. If your data shows that both patches hold a similar amount of achievable revenue, then congratulations—your territories are balanced.

Aligning Territories with Representative Skills

The final piece of the puzzle—and the one that’s most often overlooked—is aligning territories with the unique skills of your reps. A one-size-fits-all plan completely ignores the human element that actually closes deals.

Think about the talent on your team:

- The Enterprise Closer: Got a rep who shines when navigating complex, multi-stakeholder deals with long sales cycles? They belong in the territory packed with your high-value enterprise prospects.

- The High-Velocity Specialist: Have a rep who thrives in a fast-paced environment, closing dozens of smaller, transactional deals every month? Their skills are a perfect match for an SMB-focused territory.

- The Technical Expert: If one of your reps has a deep understanding of a specific industry or product, it’s a no-brainer. Assign them to the corresponding vertical or product-based territory.

When you match reps to territories where their natural abilities can flourish, you’re not just being fair. You’re building a high-impact structure that fuels both individual performance and company-wide growth. This turns territory planning from a simple logistical exercise into a powerful strategic weapon.

Executing Your Plan and Measuring Success

A brilliant sales territory plan is just a document until you bring it to life. Flawless execution separates the plans that gather dust from those that drive real revenue growth. This is where your strategy meets the real world, and success hinges on clear communication and diligent tracking.

The rollout process is a delicate one. Just sending out an email with new territory assignments is a recipe for resistance and confusion. Your sales team needs to understand the "why" behind the changes. You have to frame the new plan not as a reshuffle, but as a strategic move to create more balanced, equitable opportunities for everyone to hit their number.

Communicating the Vision to Your Team

Getting buy-in from your sales reps is non-negotiable. When you present the new territories, lead with the data. Show them exactly how the territories were balanced based on potential, not just geography or account count. Transparency is what builds trust.

Walk them through the logic. Explain how the new structure aligns with the company's growth goals and, more importantly, how it sets each individual up for a better shot at hitting—and exceeding—their quota.

A common mistake is focusing only on the mechanics of the plan. Instead, focus on building motivation. Show each rep a clear, data-backed path to success within their new patch. When they see the opportunity, they become champions of the change, not obstacles.

And don't forget to create a forum for feedback. Listen to their initial concerns. Sometimes, a rep on the ground has insights your data might have missed. Being open to minor adjustments shows you respect their expertise and are truly invested in their success.

Key Metrics for Measuring Territory Performance

Once the plan is live, you need to track what's working and what isn't. Instincts are useful, but data is definitive. Your CRM and sales analytics tools are your best friends here. You have to monitor a specific set of key performance indicators (KPIs) to get a true measure of your plan's effectiveness.

Here are the essential metrics to keep a close eye on:

- Quota Attainment per Territory: This is the ultimate test. Are reps across all territories hitting their numbers? If performance is skewed heavily toward a few territories, it’s a red flag that your balancing might need another look.

- Sales Cycle Length: Is the new structure helping reps close deals faster? A shorter sales cycle in a particular territory could indicate a great rep-to-market fit.

- Customer Acquisition Cost (CAC): Track how much it costs to land a new customer in each territory. Efficient territories will have a lower CAC, showing your resources are being deployed effectively.

- Market Penetration: Are you actually increasing your footprint in target accounts or verticals? This is especially important if a key goal of your plan was to break into a new market.

- Lead Conversion Rate: Effective territories often generate better quality leads. To improve this, consider exploring new tactics. For instance, our guide on lead generation for startups offers practical frameworks that can complement your territory strategy.

Establishing a Regular Review Cadence

Your sales territory plan is not a "set it and forget it" document. It’s a living strategy that needs to adapt to your business and the market. The most successful sales organisations build a formal review cadence right into their operational rhythm.

A quarterly review is ideal for checking in on performance against your KPIs. These sessions are perfect for spotting early warning signs, like a territory that's consistently underperforming or a rep who is completely overwhelmed.

At least semi-annually or annually, you should conduct a more in-depth assessment. This is your chance to address bigger shifts, such as new product launches, significant changes in the competitive landscape, or rep turnover. These reviews keep your plan agile and ensure it continues to support your company's strategic goals, making data-backed adjustments the norm, not the exception.

Of course. Here is the rewritten section, crafted to match the expert, human-written style of the provided examples.

Common Questions About Sales Territory Planning

Even the best-laid territory plans come with a few nagging questions. It’s only natural. You're deep in the trenches, juggling data, accounts, and personalities, and you start to wonder about the timing, the hidden traps, and how to handle the inevitable human element of it all.

Think of this as your field guide for those moments. We’re tackling the toughest, most common questions that pop up when you're turning a strategic map into a real-world plan.

How Often Should We Redesign Our Sales Territories?

There isn’t a single magic number here, but a solid rule of thumb is to do a full, top-to-bottom redesign every one to two years. Of course, big shake-ups—a merger, a new flagship product launch, or a major shift in the Irish market—should trigger an immediate review. Those events completely redraw the map, making your old plan obsolete overnight.

But you can't just wait for the big one.

Treat your territory plan as a living document, not something you carve in stone. The most successful sales organisations I've seen conduct smaller reviews and rebalancing exercises quarterly or at least semi-annually.

This keeps you agile. It lets you adapt to smaller shifts, like a rep leaving or a new pocket of opportunity emerging in a specific county, without the massive disruption of a full overhaul.

What Are the Biggest Mistakes to Avoid?

I’ve seen too many well-intentioned territory plans fall apart because of a few common, completely avoidable mistakes. Just knowing what they are is half the battle.

Here are the traps I see most often:

- Relying only on geography: This is the classic blunder. Carving up territories based on counties or provinces while ignoring account potential is a recipe for massive imbalance.

- Failing to involve your reps: Designing the plan in an ivory tower and just handing it down is the fastest way to kill buy-in. Your team won’t just dislike it; they’ll actively resist it.

- Using incomplete or 'dirty' CRM data: You can't build a solid house on a shaky foundation. A plan built on flawed data will always lead to flawed territories. Garbage in, garbage out.

- Creating poorly sized territories: It's a balancing act. Patches that are too big leave money on the table. Territories that are too small just overwhelm reps and cap their earnings.

- The 'set it and forget it' mindset: A plan that's never reviewed against actual performance data is doomed. It slowly becomes irrelevant and, eventually, completely ineffective.

How Do I Handle Sales Rep Pushback?

Let’s be honest: pushback is practically guaranteed. But it doesn't have to derail everything. Your two best weapons here are transparency and data. You have to communicate the "why" behind every change, clearly and openly.

Don't just tell them—show them. Walk your reps through the data. Demonstrate how the new structure creates a fairer, more equitable shot at success for everyone. When a rep sees a clear, viable path to hitting their quota, their entire perspective can shift from defensive to optimistic.

Here’s another pro-tip: bring your senior, most respected reps into the planning process early. They can become champions for the change, building consensus with their peers. And finally, listen to legitimate concerns. A rep might have on-the-ground intel about a key account that your data simply missed. Being open to small, sensible adjustments shows you respect their expertise and builds incredible trust.

What Tools Actually Help with Territory Planning?

A spreadsheet might get the job done when you're a scrappy team of two or three. But as soon as you start to grow, you’ll outgrow it fast. Once your team expands, you need specialised software that can handle real complexity and plug right into your CRM. Thinking about how to grow is key, and you can learn more about powerful market penetration strategies that go hand-in-hand with smart territory design.

Modern tools bring some serious firepower that automates the heavy lifting:

- Data Visualisation and Mapping: Instead of just looking at rows of data, you can see your territories, accounts, and potential laid out on an interactive map. It’s a game-changer for spotting opportunities.

- Automated Balancing: You can let algorithms do the initial work, suggesting balanced territories based on multiple variables like account potential, rep workload, and even travel time.

- 'What-If' Scenarios: This is huge. You can model different territory structures to see the potential impact on quotas and commissions before you roll anything out to the team.

At DublinRush, we're obsessed with providing B2B teams in Ireland with the data and frameworks needed for strategic growth. Our platform is designed to help you move beyond guesswork and build a predictable sales engine. Discover how DublinRush can accelerate your market expansion.