Decoding International Expansion Strategy Success

Going global is about more than just adding new pins to a map; it represents a fundamental change in how your business operates. Think of your domestic success as mastering a specific sport. An international expansion strategy is like deciding to compete in the Olympics—the rules are different, the competition is world-class, and your entire approach needs a serious overhaul. A common mistake is assuming the playbook that made you a champion at home will work on the world stage. It's a dangerous assumption that has sidelined many otherwise successful companies.

Leaders who succeed on a global scale approach new markets with a mix of confidence and curiosity. They step away from the comfort of their home turf and into the uncertainty of international business. This means asking deep, probing questions about new environments, not just looking at surface-level data. The businesses that flourish aren't always the ones with the biggest budgets, but those with the most flexible mindsets. They know a winning strategy is less about exporting a finished product and more about creating value within a new cultural and economic setting.

The Readiness Mindset: Beyond Ambition

A strong desire to grow is a start, but it's not enough. Being truly ready for an international expansion strategy requires an honest look at your company’s strengths, weaknesses, and, most importantly, its ability to adapt. This internal check-up is the first crucial step. Leaders must ask themselves tough questions:

- Financial Resilience: Do we have the capital to fund the initial launch and also sustain operations during a potentially long period of low or no returns?

- Operational Agility: Can our supply chain, technology, and internal processes handle different regulations, languages, and time zones?

- Talent and Leadership: Does our leadership team have the global awareness and cultural intelligence needed to manage a diverse, international workforce?

- Product Flexibility: Does our core product or service solve a universal problem, or is its appeal tied to the specific culture and needs of our home market?

Answering these questions honestly separates ambitious daydreams from actionable strategic plans. This evaluation helps determine whether your global push will become a powerful new engine for growth or just an expensive lesson. For more insights and articles on international business, you can explore the resources on the Connectflux Blog.

Aligning Strategy with Global Economic Currents

Your internal readiness must also connect with what's happening in the global market. A solid international expansion strategy is closely tied to worldwide trade trends. For example, recent figures showed that merchandise trade among G20 countries saw significant growth, with exports up by 2.0% and imports rising by 3.1% in early 2025. This points to a healthy and active global marketplace.

By understanding these economic flows, businesses can better time their entry into new markets and predict demand, turning large-scale trends into a real advantage. You can find a deeper analysis of these international trade statistics and their implications on the OECD website. This context ensures your strategy is based on current realities, not outdated ideas.

Your Market Intelligence Playbook

A strong **international expansion strategy** doesn’t start when your product hits a new shore. It begins with intelligence gathering, much like a detective piecing together clues before making a move. Relying on surface-level data alone is like trying to navigate a city with just a map—you see the streets, but you miss the culture, the energy, and the hidden risks. The goal of market intelligence is to validate an opportunity so thoroughly that you understand its true potential.

This process is what separates genuine growth prospects from costly misadventures. It’s about digging deeper than basic demographics to find the subtle cultural currents, competitive blind spots, and regulatory pitfalls that could sink your expansion. Smart companies don’t just ask if people will buy; they ask why they buy, how they make choices, and what it would take to earn their business. This groundwork builds a resilient and informed strategy.

The PESTLE Framework: Your Investigative Lens

To give your investigation structure, the PESTLE analysis (Political, Economic, Social, Technological, Legal, Environmental) is a fantastic framework. Think of it as a systematic checklist that ensures you examine your target market from every critical angle, leaving no stone unturned.

- Political: How stable is the government? What are the trade and tax policies? A sudden political change can turn a promising market into a high-risk gamble.

- Economic: What’s the economic climate like? Look at inflation, exchange rates, and consumer purchasing power. For instance, global economic growth is forecast to be 3.3% for 2025 and 2026, which sits below the historical average. This might mean facing more moderate demand in new markets. You can explore a detailed global economic outlook from the IMF to understand these trends better.

- Social: What are the cultural norms, values, and lifestyle trends? A message that lands perfectly in Dublin could be completely off-key or even offensive in Dubai.

- Technological: What is the state of technology? Is the infrastructure there to support your product or service?

- Legal: What are the local laws around employment, data privacy (like GDPR in Europe), and consumer protection?

- Environmental: Are there any environmental regulations or climate factors that could affect your operations or supply chain?

From Data to Decisions: Validating the Opportunity

After collecting information with the PESTLE framework, it’s time for validation. This is where you test your theories in the real world. It’s not just about confirming what you assume; it’s about discovering what you didn’t know you didn’t know.

Start by identifying your Total Addressable Market (TAM), but don’t end there. Narrow it down to your Serviceable Available Market (SAM)—the segment you can realistically reach—and then to your Serviceable Obtainable Market (SOM), which is your specific, short-term goal. This approach stops you from overestimating the opportunity and helps you use your resources wisely.

A clear understanding of your obtainable market also allows you to build a more precise financial model, a crucial part of figuring out how to reduce your customer acquisition cost in a new region. A smaller, well-defined target is always better than a large, vague one. This disciplined approach to market intelligence builds a solid, evidence-based foundation for your international expansion, greatly improving your chances of success.

Mastering International Risk Without Paralysis

Venturing into new global markets always involves risk. A well-designed international expansion strategy isn't about trying to eliminate every single threat—an impossible goal that often leads to "analysis paralysis." Instead, the objective is intelligent risk management. This means building a business that is not just resilient but antifragile, a state where shocks and stressors actually make you stronger.

Think of it like a boxer training for a major fight. Every sparring session, every hit taken, sharpens reflexes and builds strength. In the same way, a business that prepares for disruptions can turn potential threats into a competitive edge. Many companies have been caught off guard by sudden currency shifts or unexpected regulatory changes, but those with solid risk plans often emerge stronger than their rivals. The key is to shift from a reactive to a proactive mindset, identifying challenges before they become crises.

From What-Ifs to Actionable Scenarios

Effective risk management starts with practical scenario planning. This isn’t about gazing into a crystal ball; it's about creating believable stories of what could happen and deciding how your company would respond. This process helps you spot early warning signals—small market shifts that hint at bigger changes on the horizon.

For example, geopolitical tensions and uncertain trade policies are major factors for global businesses. In early 2025, the Economic Policy Uncertainty Index hit its highest level this century, and financial fear indexes also spiked. A company monitoring these trends would have been better positioned for supply chain issues or surprise tariffs. You can read the full World Bank analysis on these economic trends to get a clearer picture of the environment.

A Practical Framework for Risk Assessment

To bring structure to this process, a risk assessment matrix is an invaluable tool. It helps you categorize potential risks, estimate their likelihood and impact, and outline clear strategies to manage them. This approach turns abstract worries into a concrete action plan.

Here is a framework comparing different risks, their likelihood, and potential mitigation strategies.

International Expansion Risk Assessment Matrix

A comprehensive framework comparing different types of risks companies face during international expansion, their likelihood, and mitigation strategies

| Risk Type | Likelihood | Impact Level | Mitigation Strategy | Monitoring Frequency |

|---|---|---|---|---|

| Political Stability | Medium | High | Diversify investments across multiple regions; purchase political risk insurance. | Quarterly |

| Currency Fluctuation | High | Medium | Use currency hedging contracts; invoice in a stable currency (e.g., USD, EUR). | Monthly |

| Regulatory Changes | High | Medium | Employ local legal counsel; build flexibility into contracts and operations. | Bi-Annually |

| Cultural Missteps | High | Low-Medium | Conduct deep cultural training; hire local leadership for key roles. | Ongoing |

| Supply Chain Disruption | Medium | High | Vet and secure multiple suppliers; maintain a safety stock of critical components. | Monthly |

This table helps transform abstract concerns into a clear, manageable checklist for your expansion plans.

Ultimately, mastering international risk is a balancing act. You need to be cautious enough to protect your investments but bold enough to capture opportunities as they appear. By creating response plans before you need them, you gain the flexibility to act decisively, not out of fear. This turns the uncertainty of global expansion into a manageable part of your growth story.

Choosing Your Market Entry Strategy That Fits

After completing your research and risk analysis, the next crucial step in your international expansion strategy is deciding how to enter the new market. This isn't a minor detail; it's the foundation of your entire international effort. Choosing the wrong method is like trying to build a house on sand—no matter how great your product is, the entire structure is at risk if the foundation is weak. Every approach comes with a different balance of cost, control, risk, and speed.

Your company's specific situation—its size, funding, and long-term goals—will dictate the best path forward. Think of it like planning a journey. A backpacker with a tight budget might opt for buses and hostels (low cost, less control), while a seasoned executive might fly first class and stay in luxury hotels (high cost, full control). Both get to their destination, but the resources required and the experience are worlds apart. A startup won't have the same options as a multinational corporation, so the choice must be realistic.

Common Market Entry Methods: A Practical Comparison

There's no single "best" method for going global. The right choice is the one that aligns with your company's resources, risk tolerance, and ambitions. Let's explore the most common entry strategies to see which might be the best fit for you.

To help you weigh the pros and cons, the table below compares the most common market entry methods, outlining their resource needs, risk levels, and the degree of control you can expect.

International Market Entry Strategies Comparison

Detailed comparison of different market entry methods, their resource requirements, risk levels, and expected timelines

| Entry Method | Initial Investment | Risk Level | Time to Market | Control Level | Best Suited For |

|---|---|---|---|---|---|

| Direct Exporting | Low | Low | Fast | Low | Businesses testing a new market or with products needing minimal adaptation. |

| Licensing/Franchising | Low | Moderate | Fast | Low-Moderate | Companies with strong intellectual property (brand, tech) looking for rapid, low-cost expansion. |

| Joint Ventures | Moderate | Moderate-High | Moderate | Shared | Firms needing local expertise, distribution networks, and shared financial risk. |

| Strategic Alliances | Low-Moderate | Low-Moderate | Varies | Shared | Companies seeking collaboration for specific goals (e.g., marketing, distribution) without a new legal entity. |

| Acquisition | Very High | High | Fast | High | Well-funded corporations wanting immediate market presence and established operations. |

| Greenfield Investment | Very High | Very High | Slow | Very High | Companies that need maximum control and want to build their brand and culture from scratch. |

This table shows that lower-investment strategies like Direct Exporting offer a fast, low-risk way to test international demand, but they sacrifice control over your brand and customer experience. On the other end, a Greenfield Investment gives you total control but requires a massive commitment of time and capital, carrying the highest risk.

Let's break these down further:

Direct Exporting: This is often the most straightforward starting point. You simply produce your goods at home and sell them to customers or distributors in the new market. It’s a great way to test the waters with minimal financial exposure, but you give up control over how your product is marketed and sold.

Licensing and Franchising: With this model, you grant another company permission to use your intellectual property—like a brand name, patent, or production process—for a fee. It’s a fast, low-cost way to expand, but it comes with a major catch: you lose direct oversight of quality and operations. If your partner doesn't maintain your standards, your brand's reputation could be damaged.

Joint Ventures: This strategy involves partnering with a local company to form a new, jointly owned business entity. A joint venture provides instant access to local market knowledge, established networks, and shared costs. However, these partnerships can be tricky; misaligned goals or cultural clashes can lead to costly and complicated "corporate divorces."

Strategic Alliances: A less formal arrangement than a joint venture, a strategic alliance is a collaboration between two or more companies for a specific purpose, like co-marketing or sharing distribution channels, without creating a new company. This offers flexibility but often lacks the deep commitment of a formal partnership.

Acquisition or Direct Investment (Greenfield): This is the all-in approach. You can either buy an existing local company (acquisition) or build your own operations from the ground up (Greenfield investment). This method gives you maximum control but demands the highest financial investment and carries the greatest risk. When making such significant financial decisions, it helps to understand what financial executives want from B2B vendors to frame your proposals for maximum impact.

This decision-making process is about matching your ambition with your reality.

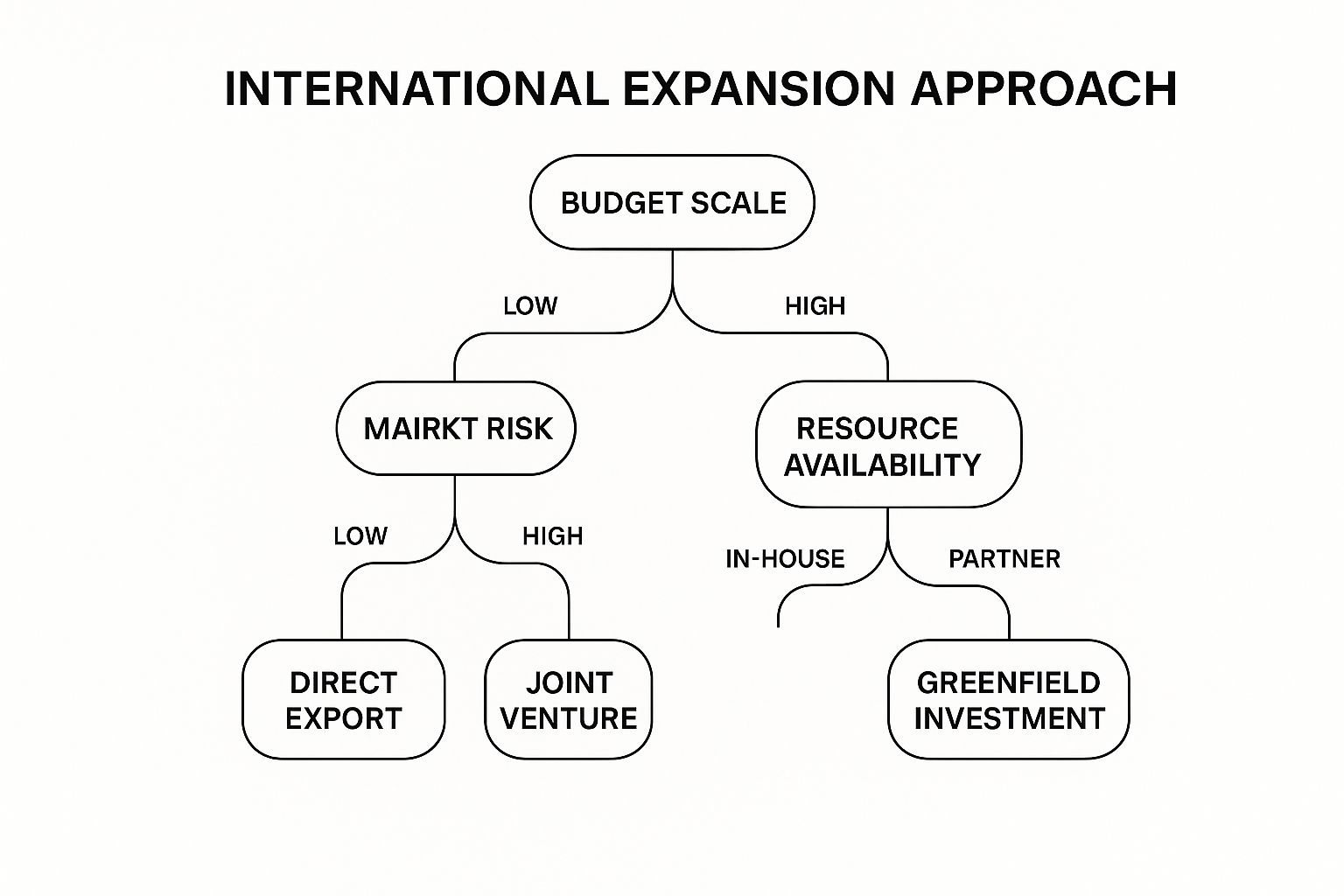

As the infographic illustrates, companies with lower budgets and resources tend to gravitate towards direct exporting, while those with significant capital can consider higher-risk, higher-control options like Greenfield investments. This framework helps you avoid overcommitting to a strategy your business can't support in the long run.

Localization Strategies That Actually Connect

The graveyard of failed international ventures is full of companies that mistook simple translation for a genuine connection. A word-for-word translation of your website is just the price of entry; a smart international expansion strategy digs much deeper. It’s all about localization, the art of adapting your entire offering—from the product itself to your marketing messages—to resonate with the cultural heartbeat of a new market.

Think of it like a musician covering a famous song. A basic translation is like playing the same notes on a different instrument. True localization is reinterpreting the melody for a new genre—turning a rock anthem into a jazz standard. It feels both familiar and exciting to the new audience because you’ve adapted it to their tastes while keeping the original spirit intact. This effort isn’t about losing your brand, but presenting it in a way the local market can understand and welcome.

Beyond Words: Adapting Your Product and Marketing

Effective localization means looking closely at every customer touchpoint. What works brilliantly in one country might fall flat or even cause offense in another. It’s a process of asking what truly matters to local customers and being brave enough to make adjustments.

- Product Modifications: Sometimes, the product itself needs to change. McDonald's is a master of this. In India, where a large portion of the population avoids beef, they didn't just give up. They introduced the McAloo Tikki, a burger with a spiced potato patty. This wasn’t a betrayal of their brand; it was a clever adaptation to local culture that became a huge hit.

- Marketing and Imagery: The visuals and messages in your campaigns are loaded with cultural cues. An ad featuring a family that looks typical in the United States might not connect with an audience in Japan. Colors also carry powerful meanings—white is associated with mourning in many Eastern cultures, while in the West, it symbolizes purity. A simple mistake here can alienate customers instantly.

- Pricing and Payment Methods: Your pricing must make sense in the local economy. A price that seems reasonable in Dublin might be too high in Lisbon. Furthermore, payment preferences differ wildly. Credit cards are standard in the US, but in Germany, direct bank transfers are popular, and across Asia, mobile wallets often rule. Forcing customers into an unfamiliar payment process is a sure way to lose sales.

Building Bridges Through Local Partnerships and Feedback

One of the fastest ways to understand a new market is by forming real partnerships with locals. A local distributor, marketing agency, or even a key employee can act as your cultural guide. They offer insights you’ll never find in a market report because they understand the unwritten rules and the competitive environment from the inside.

You also need to create strong feedback loops. Actively listen to your first local customers and team members, as their early experiences are priceless. Are they confused by your app's layout? Do they find your support hours inconvenient? This direct feedback helps you quickly fix early mistakes and turn them into valuable lessons. For companies eyeing the Irish market, getting these details right is essential. For more on this, check out our guide on localizing B2B messaging for the Irish market.

In the end, a winning localization strategy is built on empathy. It means stepping outside your own cultural bubble to see your business through a new customer's eyes. It’s a commitment not just to sell in a new market, but to become a welcome part of it.

Building Operations That Scale Across Borders

A great product and clever marketing can get you noticed, but a successful international expansion strategy is built on an operational backbone that can handle the pressures of global scale. Managing operations across different countries, time zones, and cultures is a completely different game than running a domestic business. Many companies discover this the hard way, finding that the efficient processes they relied on at home become sources of chaos and unexpected costs abroad.

The core challenge is striking the right balance between standardization and flexibility. Think of your key operational processes like a franchise model. The secret recipe—the essential elements that define your quality and efficiency—must be consistent everywhere you operate. However, the store's layout and local menu specials need to adapt to the neighborhood. Deciding what stays the same versus what changes is a critical strategic choice that will define your ability to scale internationally.

The Standardization vs. Flexibility Matrix

To scale effectively, you need a clear framework for deciding which processes must be identical everywhere and which need a local touch. This isn't just about being efficient; it's about maintaining your quality standards and brand promise as you grow.

Here is a simple way to approach this decision:

Standardize Core Processes: These are the functions that form the heart of your business and give you a competitive edge.

- Financial Reporting: A single, unified system is non-negotiable for maintaining visibility and control.

- Core Product Quality Standards: The quality of a product made in Germany must be identical to one assembled in Brazil.

- Brand Guidelines: Your core brand message and identity have to remain consistent to build recognition across the globe.

- Cybersecurity Protocols: Security standards must be universally high to protect the entire organization from threats.

Localize Adaptive Processes: These functions are often customer-facing or heavily influenced by local laws and cultural norms.

- Hiring Practices: Labor laws, available talent, and cultural views on work-life balance vary dramatically from one country to another.

- Customer Support: Language, time zones, and common local problems require a tailored, local approach.

- Supply Chain and Logistics: Sourcing materials and distributing products must be optimized for local infrastructure, suppliers, and regulations.

- Sales and Marketing Tactics: As you scale, effective SaaS operations management is vital, but the specific sales motions often need to be adjusted for local markets.

Managing Remote Teams and Quality Control

When you can't be in every location to personally oversee operations, trust and systems become your most important assets. Managing remote international teams demands a deliberate communication strategy. This means setting up clear channels, establishing expectations for response times across different time zones, and using technology to create a sense of a single, unified team. For example, a weekly all-hands video call can align global teams, while a shared project management tool ensures everyone is on the same page.

Controlling quality from a distance depends on data and empowering your local teams. Instead of direct oversight, you'll rely on key performance indicators (KPIs) and regular audits. For a manufacturing plant, this might be tracking defect rates. For a sales office, it could be customer satisfaction scores. You can explore excellent ideas for this in our complete framework for scaling B2B sales in Ireland, which stresses the value of localized metrics. By giving local managers the authority to meet these standards, you create a system that upholds quality without causing bottlenecks at headquarters.

Learning From Real International Expansion Wins

The screenshot above captures the academic definition of international business: the cross-border trade of goods, services, and capital. But the real lessons come from seeing how companies navigate these flows in the real world, turning theory into profit.

The best way to understand global growth is to study companies that have already done it successfully. An international expansion strategy isn't just a document; it's a collection of tough decisions, smart pivots, and hard-earned wins. By looking at real-world examples, we can see how strategic frameworks lead to tangible results. These stories offer more than just inspiration—they provide a practical blueprint of what works.

The Starbucks Way: Unified Experience, Global Scale

Starbucks is a classic case study in executing an international strategy with precision. From its Seattle headquarters, the company has grown to over 32,000 stores in 80 countries. The secret to its success isn't just good coffee; it's an unwavering commitment to a standardized customer experience. A latte in Tokyo is designed to feel just like one in Dublin, from the store's familiar layout to the core menu.

This uniform approach creates major advantages:

- Economies of Scale: Centralizing key operations and maintaining a consistent product lineup generates huge efficiencies in production and supply chain logistics.

- Brand Recognition: A unified brand makes Starbucks instantly recognizable anywhere, building a foundation of trust in new markets.

- Predictable Quality: Customers know exactly what to expect, which lowers the barrier to entry when launching in a new country.

However, Starbucks isn't completely rigid. The company makes subtle yet important local adaptations, like offering mooncakes in China during the Mid-Autumn Festival. This shows that even a globally standardized strategy needs a touch of local flavor to truly connect with customers.

Luxury Brands: The Power of Origin

Luxury brands like Rolex and Hermès offer another compelling model. Their international expansion strategy is built on the prestige of their country of origin. A Rolex watch is valuable precisely because it is "Swiss made," a powerful symbol of quality and heritage. Similarly, Hermès products are sought after because they are meticulously crafted in France.

For these companies, manufacturing is intentionally centralized in their home country—not to save money, but to protect the brand's core identity. They export a consistent, high-end product across the globe, relying on the brand’s mystique to attract discerning customers. This strategy works because their audience values authenticity and heritage far more than local adaptation. It’s a powerful reminder that sometimes, the best international move is to double down on what makes you unique at home.

If your growth plans involve finding new customers, you might find our insights on how to generate B2B leads particularly helpful.

Ready to fast-track your expansion into the Irish market? DublinRush provides the data-driven frameworks and curated lead vaults you need to scale your B2B outreach. Get started with DublinRush today and turn your growth plans into action.