A competitive analysis framework isn't just a fancy term for a list of your rivals. Think of it as a structured system for gathering, analyzing, and actually acting on intelligence about your competitors. It’s the difference between randomly spying on the competition and running a full-blown intelligence operation.

What Exactly Is a Competitive Analysis Framework?

Let's use an analogy. Imagine trying to build a skyscraper. You wouldn't just show up with a pile of steel and start welding, right? You'd have an architect's blueprint—a detailed plan that maps out every single beam, window, and floor.

A competitive analysis framework is that blueprint for your business strategy. It gives you the structure and process needed to see the full competitive picture, stopping you from making knee-jerk decisions based on a tweet you saw or a rumor you heard. It's all about being proactive, not just reactive.

Without a proper structure, your research on competitors quickly turns into a messy, disorganized pile of random facts. A new feature here, a pricing change there. It's chaos. A solid framework cuts through that noise, turning it into crystal-clear insights. It provides a repeatable method to size up your competitors' strengths, weaknesses, product offerings, and how they position themselves in the market.

This systematic approach is your key to finding where you can win. It shines a light on gaps in the market, helps you anticipate what your competitors might do next, and gives you the confidence to define what makes you unique. Instead of guessing, you’re operating from a place of deep market understanding.

For B2B companies, especially those navigating the nuances of the Irish market, this structure is vital for aligning your sales and marketing teams. You can dive deeper into this in our guide to scaling B2B sales in Ireland.

The Core Stages of Analysis

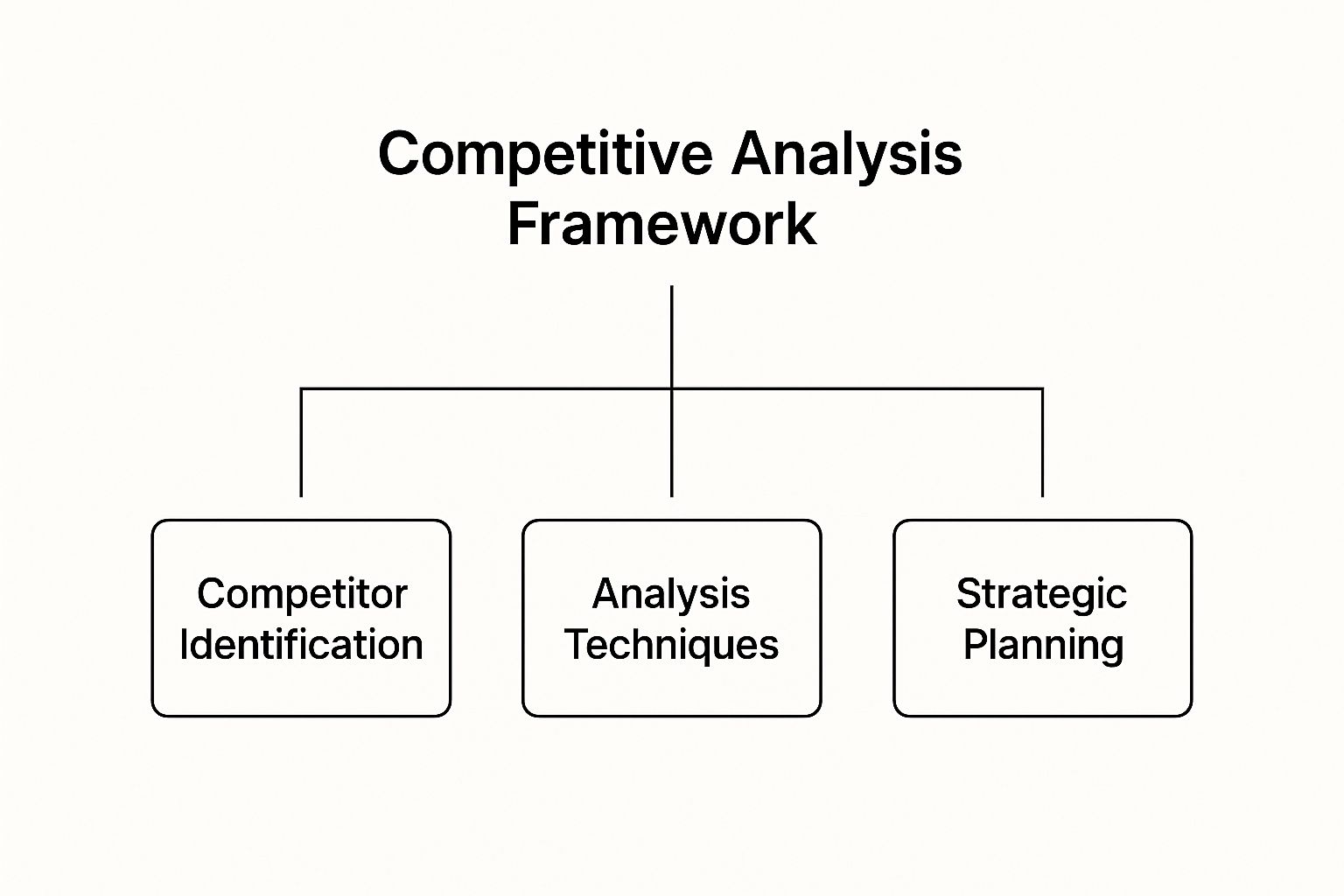

The real power of a competitive framework is its methodical flow. It’s not just one step; it’s a sequence of deliberate actions that build on each other.

The image above breaks it down beautifully. A successful framework isn’t a single action but a cycle of three critical phases: figuring out who to watch, picking the right analysis techniques, and then, most importantly, building a strategic plan from what you’ve learned.

A Structured Approach to Competitive Insights

To put this into a more structured view, here’s how the core stages of a competitive analysis framework typically break down. Each stage has a clear purpose and a set of key activities that ensure you're moving from raw data to actionable strategy.

Key Stages of a Competitive Analysis Framework

| Stage | Core Purpose | Key Activities |

|---|---|---|

| Stage 1: Assess | To identify and understand your key competitors and the market landscape. | Define competitors, research product offerings, and analyze marketing strategies. |

| Stage 2: Benchmark | To measure your performance against competitors on key metrics. | Compare pricing, features, market share, and customer satisfaction. |

| Stage 3: Strategize | To translate insights into actionable business and sales strategies. | Identify opportunities, define your unique value prop, and plan your next moves. |

This systematic process is what separates winning companies from those who are always one step behind. By following these stages, you ensure that every piece of data you collect is put to work, informing your strategy and helping you make smarter, faster decisions.

This kind of structured approach is becoming standard practice for a reason. Top consulting firms have been breaking down competitive evaluation into these three stages—Assess, Benchmark, and Strategize—for years. In fact, as of 2025, over 80% of large enterprises now use a formalized framework to guide their competitive intelligence.

The results speak for themselves. Companies report a 25% reduction in their strategic planning cycle time and an 18% increase in the success rate of their product launches when they use these rigorous models.

A competitive analysis framework turns market noise into strategic music. It provides the rhythm and structure needed to compose a winning business strategy, ensuring every move is intentional and impactful.

By bringing this discipline into your process, you guarantee that every bit of data you gather has a purpose. It all feeds into a clearer, more actionable understanding of the competitive arena, giving you the power to outmaneuver the competition.

Of course. Here is the rewritten section, following all your specified requirements for tone, style, and formatting.

Building Your Framework From the Ground Up

A powerful competitive analysis framework isn’t something you can just download and implement overnight. It’s built from the ground up, piece by piece, on a few core pillars. Think of it less like a rigid blueprint and more like a detective’s toolkit, where each tool is designed to uncover a specific clue about how to win in your market. You simply can't solve the puzzle without the right instruments.

To build something that’s actually useful, you need to gather the right intelligence across a few key areas. These pillars ensure you get a full, 360-degree view of the competitive landscape, not just an isolated snapshot that tells you half the story.

The First Pillar: Competitor Profiling

Before you can analyze anyone, you need to know who you’re up against. Competitor profiling goes way beyond just making a list of company names. It’s about creating a detailed dossier on each key player to understand their corporate DNA and what they’re trying to achieve strategically.

Who are they really? What’s their company history, and who are the leaders calling the shots? Understanding their background often reveals patterns in their decision-making. For instance, a company founded by engineers might obsess over product innovation at the expense of marketing, while one run by sales veterans might focus aggressively on customer acquisition above all else.

To build a solid profile, you need to pull together this essential data:

- Company Vitals: Gather the basics like their size (employee count, revenue), funding history, and key executives. A well-funded startup is a totally different kind of threat than a long-standing, bootstrapped business.

- Target Audience: Define who they’re selling to. Are they chasing the exact same customer segments as you, or are they carving out a different niche?

- Geographic Focus: Pinpoint their primary markets. In Ireland, for example, are they all-in on Dublin’s tech hub, or are they focused on serving regional businesses? This tells you a lot about their market penetration strategy.

The Second Pillar: Product and Service Analysis

Once your competitor profiles are fleshed out, the next pillar is a deep dive into what they actually sell. This isn’t just about looking at a feature list; it’s about understanding the value their products deliver and how that stacks up against your own. A feature-by-feature comparison is just the starting point.

You have to ask the hard questions. How do their products or services solve the customer's core problem? What’s the real-world quality and reliability of their solutions? A competitor might have a longer feature list, but if their product is buggy or their service is unreliable, that's a weakness you can drive a truck through.

A common mistake is to only compare features. True analysis compares outcomes. How does their product make the customer's life better, and how does yours do it differently or more effectively?

Your analysis should include:

- Pricing and Business Model: Document their pricing tiers, contract terms, and how they make money (e.g., subscription, one-time purchase, freemium). This directly impacts their position in the market.

- Unique Selling Proposition (USP): What makes them stand out? Is it their price point, quality, customer service, or constant innovation?

- Customer Reviews and Feedback: What do actual users have to say? Scour review sites, forums, and social media for honest feedback on what they do well and where they fall short.

The Third Pillar: Marketing and Sales Strategy

The final pillar is figuring out how your competitors attract and win customers. A brilliant product can fail with weak marketing, while a mediocre one can dominate the market with a clever go-to-market strategy. This part of your framework is all about investigating their entire approach to getting business.

For a closer look at collecting this kind of intel, you can explore guides on effective competitor social media monitoring to really understand their digital footprint. This gives you direct insight into their messaging, content, and how they engage their audience.

Here’s what you should be digging into for this pillar:

- Content and SEO Strategy: What topics are they writing about on their blog? Which keywords are they ranking for? This reveals the pain points they’re targeting.

- Social Media Presence: Analyze their activity across different platforms. Look at their follower counts, engagement rates, and the kind of content they share. This tells you how they’re building a community.

- Sales Process: How do they generate leads and close deals? Are they leaning on an inside sales team, a partner channel, or a self-service model? Understanding this helps you predict their sales motions.

By systematically building your competitive analysis framework on these three pillars—Profiling, Product Analysis, and Marketing Strategy—you create a comprehensive intelligence system. This structure transforms a pile of random data points into a clear map, guiding you toward strategic advantages and untapped market opportunities.

Choosing the Right Model for Your Analysis

Jumping into a competitive analysis doesn’t mean you have to start from scratch. In fact, you shouldn't. The most effective approach leans on proven, time-tested models that give your investigation a solid foundation.

Think of these frameworks as different lenses for your camera. Each one offers a unique perspective on the competitive landscape. A wide-angle lens gives you the big picture, a zoom lens hones in on a specific rival, and a macro lens reveals the tiny details others miss. Combining them is how you get the full, panoramic view of your market.

Instead of just listing off academic theories, we’ll get into when to use each model and, more importantly, how to layer them to get a genuine 360-degree understanding. This turns abstract concepts into practical tools you can use right away.

SWOT Analysis: The Internal and External Snapshot

The SWOT analysis is usually the first tool businesses grab, and for good reason. It’s a straightforward but powerful way to map out where your company stands against the competition. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

The real magic of SWOT is its dual focus. Strengths and Weaknesses are internal factors—things you can actually control, like your product's killer feature or your amazing sales team in Cork. On the other hand, Opportunities and Threats are external—things like market trends, a competitor’s new funding round, or economic shifts that are out of your hands but still hit your bottom line.

- When to Use It: SWOT is perfect for a quick health check or a quarterly strategy session. It gives you a high-level overview that helps you instantly spot your biggest advantages and most urgent vulnerabilities.

Porter’s Five Forces: Gauging Industry Attractiveness

Developed by Harvard Business School professor Michael E. Porter, this model zooms out beyond your direct competitors. It’s a framework for digging into an entire industry’s structure to figure out how profitable it really is. Think of it like a weather forecast for your market, showing you the major storms brewing on the horizon.

The five forces that shape any industry are:

- Threat of New Entrants: How easy is it for a new company to set up shop in your market?

- Bargaining Power of Buyers: How much power do your customers have to haggle you down on price?

- Bargaining Power of Suppliers: How much control do your suppliers have over your costs?

- Threat of Substitute Products: How likely are your customers to find a totally different way to solve their problem?

- Rivalry Among Existing Competitors: How cut-throat is the competition between the current players?

Porter’s Five Forces stops you from getting tunnel vision. It forces you to look at the bigger picture instead of just obsessing over your main rival, helping you understand the real dynamics that make an industry a goldmine or a graveyard.

When to Use It: Pull this model out when you’re thinking about entering a new market, making a huge investment, or trying to figure out why your industry is suddenly getting more or less profitable.

PEST Analysis: Understanding the Macro Environment

While Porter’s model focuses on the industry, PEST Analysis zooms out even further. It helps you examine the massive macro-environmental factors that can quietly shape your business. PEST is an acronym for Political, Economic, Social, and Technological factors.

This analysis helps you spot the big-picture trends that could become future opportunities or threats. For example, a new data privacy law (Political) could force a change in your marketing, while a recession (Economic) might completely alter how your customers spend their money.

When to Use It: PEST is a brilliant starting point for any strategic planning. It sets the stage with broad context before you dive into the nitty-gritty of your specific industry or competitors.

The sharpest competitive analysis doesn’t just pick one model; it combines them. You could start with a PEST analysis to get the lay of the land, then use Porter's Five Forces to dissect your industry’s structure, and finish with a SWOT to pinpoint your exact strategic position within that environment. A good SEO competitor analysis template can give you a structured way to pull all these insights together.

This layered approach isn't just theory—it has a real impact. Companies using a combination of frameworks have been shown to improve their win rates in competitive bids by 22% and achieve up to 30% higher shareholder returns over five years compared to those winging it.

Putting Your Framework to Work: The Market Share Takedown

Alright, you've built your competitive analysis framework. Now it’s time to put that machine to work. One of its most powerful applications is a raw, honest look at your market share—the ultimate vital sign of your competitive health.

Think of it this way: your total market is a freshly baked pizza. Market share analysis is simply about figuring out how many slices you have, who has the most, and who's sneaking an extra piece when nobody's looking. It’s how you move from theory to a tangible scoreboard.

There are a couple of ways to slice this up. You can measure by total revenue or by the total number of customers. Both tell a different story. Revenue share tells you who’s landing the big-money deals, while customer share shows you who has the broadest reach.

Calculating and Reading the Room

To get started, you first need to get a handle on the total size of the market—either the total revenue all players are generating or the total number of customers being served. Once you have that, the maths are simple.

- Market Share by Revenue: (Your Company's Total Revenue / Total Market Revenue) x 100

- Market Share by Customer Volume: (Your Company's Total Customers / Total Market Customers) x 100

Let’s say the Irish B2B software market is valued at €500 million. If your company brought in €25 million last year, you hold a 5% revenue market share. That simple number is your North Star, a clear benchmark to beat.

This isn't just a vanity metric. Companies that get granular with market share analysis see an average growth rate 15–20% higher than their peers who fly blind. It's why 73% of Fortune 500 firms are all-in on advanced tools for these exact insights. You can dig into more stats on why market share matters over at Number Analytics.

This data-driven approach is the bedrock of any solid market penetration strategies. It shines a massive spotlight on where you can—and should—be grabbing more of the pie.

Segmenting for a Sharper View

That top-level number is your starting point, but the real gold is hidden in the segments. Slicing the market into smaller pieces is where you find the juicy insights—niche opportunities, overlooked customer groups, and spots where your competitors are surprisingly weak.

You can break it down by:

- Geography: Are you the king of Dublin but invisible in Cork? Does a rival have a stranglehold on the western counties?

- Customer Size: Maybe you dominate the startup scene while a competitor cleans up with enterprise clients.

- Industry Vertical: Do you own the fintech space, while another player is the go-to for manufacturing firms?

This is how you discover that even with a 5% overall share, you might hold a whopping 25% share among tech startups in Galway. That’s not just data; that’s a roadmap. It tells you where to double down.

Tracking Trends to Stay Ahead

Finally, remember that market share isn't a "one and done" calculation. It's a movie, not a photograph. Its true power comes from tracking it over time.

Is your slice of the pie growing, shrinking, or just sitting there? Did that big product launch actually move the needle? Did a competitor’s new marketing blitz manage to steal a few of your customers? Answering these questions gives you a real-world scorecard for your strategic decisions.

For example, if you launched a service targeting the Limerick med-tech cluster, you can track your market share in that specific segment. If it jumps from 2% to 8% in six months, you have hard proof your strategy is crushing it. That’s how competitive analysis becomes less of a research project and more of a dynamic, business-steering weapon.

Turning Competitive Insights Into Sales Wins

A well-constructed competitive analysis framework is so much more than a high-level strategic document collecting dust on a server. Think of it as a tactical playbook for your frontline sales team. This is where theory meets action, where market intelligence turns into actual closed deals.

For B2B sales professionals, especially those duking it out in the crowded Irish market, these insights are pure gold.

They completely change the texture of every sales conversation. Your reps stop making generic pitches and start leading surgically precise discussions. Instead of just rattling off your product's features, they can talk about how your solution directly solves a problem their prospect is likely having with a specific competitor. It shifts the entire dynamic of the call.

Sharpening Your Sales Pitch

Let's be honest: a generic sales pitch is forgettable. But a pitch armed with competitive intelligence? That’s compelling. When a sales rep knows a rival’s product weaknesses, pricing traps, or common customer complaints, they can tailor their message to hit those pain points directly.

Imagine one of your reps is on a call and knows the prospect uses Competitor A. Instead of a bland, predictable opening, they can lead with targeted insight.

Example Script: "I understand you're currently using Competitor A, which is a solid choice for many. However, we've found that companies in your industry often run into challenges with [specific, known weakness], particularly when they start to scale. Our solution was actually built to address that exact issue head-on."

This kind of opener instantly positions your rep as a knowledgeable advisor, not just another seller. It shows they’ve done their homework and understand the prospect’s world. That builds immediate credibility and opens the door for a much deeper conversation about real value.

Confidently Handling Objections

Objection handling is a crucial skill, but it’s infinitely more powerful when it’s backed by hard data from your framework. When a prospect says, "We're happy with Competitor B," a well-prepared rep doesn't have to stumble or guess. They can fire back with specific, factual counterpoints.

- If the objection is price: Your rep can point to the hidden costs or missing features in the competitor's cheaper plan, demonstrating how your solution delivers a far better long-term ROI.

- If the objection is features: They can pivot to a unique feature your product has that solves a problem the competitor’s product completely ignores.

- If the objection is service: They can bring up your superior customer support, citing your team's faster response times or dedicated account managers—a known weak spot for the rival.

This level of preparation turns a potential roadblock into a golden opportunity to showcase superior value. Consistent training in this area is a key driver of sales performance improvement, giving your team the tools to consistently outmaneuver rivals.

Identifying High-Value Prospects

Your competitive analysis framework isn't just for defense; it’s a seriously powerful offensive tool for prospecting. By digging into your competitors' customer lists and case studies, you can pinpoint high-value accounts that might be ready to make a switch.

Look for signals of dissatisfaction. Are customers grumbling on social media or review sites about a recent price hike or a buggy update from your rival? This is a flashing green light for your sales team to reach out with a perfectly timed, highly relevant message.

Think about this proactive approach:

- Monitor Competitor Mentions: Use social listening tools to keep an eye on what people are saying about your main competitors.

- Identify Pain Points: Look for recurring complaints or frustrations. Is their new UI a confusing mess? Is their customer support painfully slow?

- Craft Targeted Outreach: Arm your sales reps with this intel so they can create personalised outreach campaigns that truly resonate.

For example, a sales email could start with, "Saw your team was asking about [competitor's issue] on LinkedIn. It’s a common challenge. We actually help companies like yours solve this by…"

This intelligence-led strategy helps your team focus its energy on prospects who are already feeling the friction and are therefore much more open to hearing about a better alternative. It transforms your sales process from a simple numbers game into a strategic operation where every conversation counts.

Translating Your Analysis Into an Actionable Strategy

Let’s be honest: analysis without action is just an expensive hobby. The whole point of digging through all that competitor data is to make a move that actually counts. This is where the rubber meets the road—turning all those spreadsheets and findings into a real, actionable plan that gives you a measurable edge.

Think of it like being a detective who's just cracked a tough case. You've gathered the clues, interviewed the witnesses, and you know exactly how the other side operates. Now it’s time to write the report that puts them on the defensive. Your frameworks, like SWOT or Porter’s Five Forces, have given you the evidence; it’s time to build your case.

From Insights to Objectives

First, you need to consolidate everything you've learned. Sift through the noise to find two critical things: your undeniable strengths and your competitors' biggest weaknesses. Look for the patterns. Did you notice your top rival consistently gets hammered in reviews for their poor customer support, while your team is getting praised? That’s not just a data point; it’s an opportunity knocking.

These core insights are the fuel for your strategic objectives. And I don't mean vague goals like "be better than the competition." They have to be sharp, specific, and measurable.

- Objective Example 1: Steal 15% of market share in the fintech space within 12 months by specifically targeting Competitor X's unhappy customers.

- Objective Example 2: Launch a new service package that fills a feature gap we found in the offerings of our top three competitors.

- Objective Example 3: Overhaul our brand messaging to scream about our superior customer service, making it a clear contrast to the biggest complaint in the market.

For Irish businesses, using data to drive sales strategy in Ireland is the key to turning these objectives into real-world results that connect with the local market. And if you want to see how this plays out on a larger scale, you can find some great insights from analyzing market leaders like Twitter and Tesla.

Creating a Strategy on a Page

To keep your whole team on the same page, from sales to product development, boil your entire plan down into a "Strategy-on-a-Page" document. It’s a simple but powerful tool to make sure everyone is pulling in the same direction.

Your goal isn’t to create the most comprehensive analysis; it’s to make the most impactful one. A single, brilliant strategic move backed by solid intel is worth a thousand pages of reports that no one reads.

This one-pager should clearly lay out your main objective, the key moves you'll make to get there, the metrics you'll use to track success, and who is responsible for each part of the plan. This simple document transforms all your hard work from a dusty report into a living, breathing guide that ensures your competitive analysis framework directly powers a lasting advantage.

Common Questions About Competitive Analysis Frameworks

Even when you've got a clear roadmap for a new system, a few questions always seem to pop up. Let's dig into some of the most common ones we hear about putting a competitive analysis framework into practice.

How often should I update my analysis?

This isn't a "set it and forget it" kind of task. In fast-moving industries, a quarterly review is a solid baseline to keep your insights fresh enough to guide your tactics.

That said, any major market shift—like a new competitor bursting onto the scene or a big technology change—should trigger an immediate update. You can't afford to wait.

How many competitors should I track?

Focus is your best friend here. Trying to track every single player in your space is a surefire way to get overwhelmed and achieve nothing.

A good rule of thumb is to focus on three to five direct competitors. These are the ones targeting the same audience with a very similar solution. You might also want to keep an eye on one or two indirect or even aspirational competitors to get a read on broader market trends.

What Is the Biggest Mistake to Avoid?

The most common trap we see is analysis paralysis—getting so lost in the weeds of data collection that you never actually do anything with it. Your goal isn't to write the world's most perfect, all-knowing report. It's to find actionable insights that give you a real strategic edge.

The purpose of a competitive analysis framework is not to know everything about your competitors. It's to know enough to make smarter, faster decisions than they do. Prioritize action over endless information gathering.

Remember, a good framework produces a clear, focused plan. Think of it as a tool for decisive action, not just a research project. Also, make sure any data collection is compliant. Understanding regulations is key, and our GDPR compliance checklist is a valuable starting point for any Irish business gathering market intelligence.

Ready to turn competitive insights into scalable growth? The team at DublinRush provides the data-driven frameworks and tactical playbooks B2B teams in Ireland need to win. Check out our resources at https://dublinrush.com.